CA Foundation Classes

Live Online| Recorded | Offline

New Batch Start From

(Fast Track Batch Available)

| September 2025 |

|---|

| Call Now: (+91) 7290089902 |

Get a Call Back

Modes of CA Foundation Classes

| Face to Face Classes | Online | Google Drive |

|---|---|---|

| Live at Home | Live at Center | Pendrive Classes |

| Enquire Now |

Why IGP for CA Foundation Classes?

IGP takes immense proud in producing toppers over 25+ years now and even this year as well, CA Foundation DELHI TOPPER with 345/400 Marks was possible because of our quality tutoring.

- Most Experienced Faculty

- 100% Concept Clarity

- Unique Syles of Teaching

- Daily Homework

- Regular Mock Tests

- Doubt Solving and Revision Classes

- Personlised Guidance and Study Plans for Students

- 24x7 Student Assitance

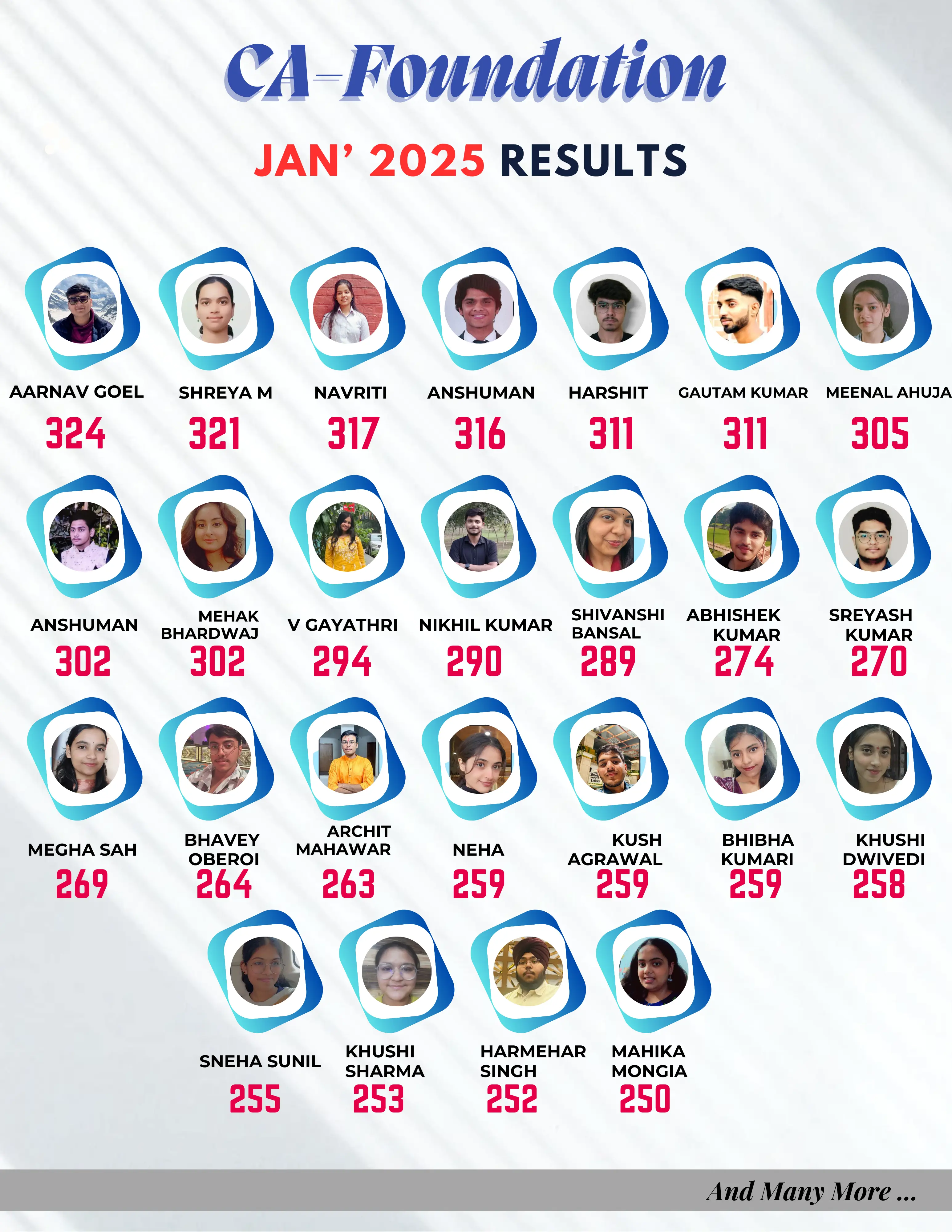

IGP CA Found. Toppers

Demo Lectures for January, May, September 2026 Exams

We provide detailed explanation of the subject matter and cover all the essential information that a student needs, have a look!

CA Foundation Eligibility for 2026

- Candidates must have passed the Class 12 examination from a recognized educational institute with a minimum of 50% marks in aggregate.

- There is no age limit for appearing in the CA Foundation Exam.

- Candidates who are appearing in Class 12 can also register for the CA Foundation Exam, but their admission will be provisional and will be regularized only after they clear Class 12 with the required minimum marks.

Call Now: (+91) 7290089902

CA Foundation Exam Course for 2026

CA Foundation course is divided into 4 subjects-

Accounting, Business laws, Quantitative Aptitude and Business Economics.

Each paper will carry 100 marks.

"Accounting" and "Business laws" exams have subjective-type questions with no negative marking and duration of 3 hours whereas "Quantitative Aptitude" and "Business Economics" exams have objective-type questions with -0.25 negative marking for every wrong answer and duration of 2 hours.

Candidates have to get a minimum of 40% marks in each paper and a minimum of 50% marks in aggregate in all papers to pass the CA Foundation exam.

| Paper | Marks | Type of Question |

|---|---|---|

| 1: Accounting | 100 Marks | Subjective |

| 2: Business Laws | 100 Marks | Subjective |

| 3: Quantitative Aptitude: Part A: Business Mathematics Part B: Logical Reasoning Part C: Statistics |

100 Marks Part A: 40 Marks Part B: 20 Marks Part C: 40 Marks |

Objective |

| 4: Business Economics | 100 Marks | Objective |

Call Now: (+91) 7290089902

Frequently Asked Questions - CA Foundation Classes

Ques 1. How to Study for CA Foundation and Clear it in First Attempt?

First of all you need a positive outlook towards CA Foundation exams, we all know that cracking CA Foundation exam in first attempt is a challenge but with right mentorship, time management skills, thorough understanding of subjects, regular revisions and performance analysis tests and a healthy lifestyle you can surely crack the CA Foundation in one go!

Ques 2. What are Some Subject Wise Tips to Clear CA Foundation Exams?

- Accounts- Daily practice is required, solving mock test papers is a must if one wants to score high in accounts.

- Business Law- Most of the students are not familiar with this subject so one needs to gain writing practice and interpretation skills to score good in law. continuous revision is the key here.

- Quantitative Aptitude- The exam is divided into 3 parts- Business mathematics, logical reasoning and statistics so one really needs to work upon its calculation skills.

- Business Economics- Focus on grasping basic concepts first.

Ques 3. Can I pass CA Foundation exam with online coaching?

Yes absolutely you can, online coaching gives you the benefit of studying at your own comfort. Online classes also save your time and effort on transportation.

Ques 4. How can I register myself for CA Foundation exam?

CA Foundation exam is conducted thrice a year- January, May and September. You need to visit the official website of ICAI i.e. www.icai.org. Fill out the registration form, necessary details, submit the documents and pay the fees.

Ques 5. What is the validity period of CA Foundation registration?

CA Foundation registration is valid for three years, allowing students six attempts. After three years, students can revalidate their registration by paying a revalidation fee of Rs. 300.

Ques 6. What is the minimum passing marks for CA Foundation exam?

Students need to achieve a minimum of 40% marks in each subject whereas an overall aggregate of 50% marks.

Ques 7. Should I start CA Foundation coaching during school time or after passing?

The syllabus of CA Foundation is somewhat similar to the syllabus of Class 11 and 12. Subjects like Economics and Accounts are common and for some students Mathematics also. Law is generally a new subject for students for which you need proper guidance and even coaching in some areas. You can surely prepare for CA Foundation whilst in your school time but that will require a bit more of your effort and time but this will help you in achieving your goal in lesser time than your competitors.

Ques 8. Does IGP provide demo classes for CA Foundation?

Yes, IGP Classes provides Free Demo lectures, available on our Youtube Channel- IGP Classes and on our official website too.

Ques 9. Does IGP conducts regular revision classes and mock tests?

Yes absolutely. IGP classes is known for conducting chapter wise as well as complete syllabus revisions and tests on a regular basis. Free Revision classes are also conducted on our YouTube channel a month before examinations so that students can achieve to the best of their ability.

Ques 10. What is the fee structure of IGP’s Foundation Classes?

You can go for whole syllabus coaching classes(combo) and also for subject wise classes as per your choice in Face to Face, Live at centre, Google Drive/Pendrive or Live at Home mode. Visit shop.igpinstitute.org for early bird offers and other discounts on our products.

Ques 10. Where are the IGP Centres located for CA Foundation classes?

IGP Classes centres are conducted at Laxmi Nagar, Janakpuri, and Rohini in Delhi.

CA Foundation Course Syllabus for 2026 Exams

Objective- To develop an understanding of basic concepts and principles of accounting and apply the same financial statements and simple problem solving.

- Chapter 1: Theoretical Framework

- Chapter 2: Accounting Process

- Chapter 3: Bank Reconciliation Statement

- Chapter 4: Inventories

- Chapter 5: Depreciation and Amortisation

- Chapter 6: Bills of Exchange and Promissory Notes

- Chapter 7: Preparation of Final Accounts of Sole Proprietors

- Chapter 8: Financial Statements of Not-for-Profit Organisations

- Chapter 9: Accounts from Incomplete Records

- Chapter 10: Partnership and LLP Accounts

- Chapter 11: Company Accounts

Objective- To develop general legal knowledge of the laws of contracts, sales and understanding of various forms of businesses and their functioning to regulate business environment and acquire the ability to address basic application oriented issues.

- Chapter 1: Indian Regulatory Framework

- Chapter 2: The Indian Contract Act, 1872

- Chapter 3: The Sale of Goods Act, 1930

- Chapter 4: The Indian Partnership Act, 1932

- Chapter 5: The Limited Liability Partnership Act, 2008

- Chapter 6: The Companies Act, 2013

- Chapter 7: The Negotiable Instruments Act, 1881

This subject is further divided into 3 parts-

Business Mathematics

Logical reasoning

Statistics

Objective- To develop an understanding of basic mathematical and statistical tools and apply the same in business, finance and in economic situation whereas to develop logical reasoning skills.

PART-A: BUSINESS MATHEMATICS

- Chapter 1: Ratio and Proportion, Indices, Logarithms

- Chapter 2: Equations

- Chapter 3: Linear Inequalities

- Chapter 4: Mathematics of Finance

- Chapter 5: Basic Concepts of Permutations and Combinations

- Chapter 6: Sequence and Series – Arithmetic and Geometric Progressions

- Chapter 7: Sets, Relations and Functions, Basics of Limits and Continuity functions

- Chapter 8: Basic Applications of Differential and Integral Calculus in Business and Economics

PART-B: LOGICAL REASONING

- Chapter 9: Number Series, Coding and Decoding and Odd Man Out

- Chapter 10: Direction Tests

- Chapter 11: Seating Arrangements

- Chapter 12: Blood Relations

PART-C: STATISTICS

- Chapter 13: Unit I: Statistical Representation of Data, Unit II: Sampling

- Chapter 14: Measures of Central Tendency and Dispersion

- Chapter 15: Probability

- Chapter 16: Theoretical Distributions

- Chapter 17: Correlation and Regression

- Chapter 18: Index Numbers

Objective- To develop an understanding of concepts and theories of economics and to acquire the ability for addressing the application oriented issues.

- Chapter 1: Nature & Scope of Business Economics

- Chapter 2: Theory of Demand and Supply

- Chapter 3: Theory of Production and Cost

- Chapter 4: Price Determination in Different Markets

- Chapter 5: Business Cycles

- Chapter 6: Determination of National Income

- Chapter 7: Public Finance

- Chapter 8: Money Market

- Chapter 9: International Trade

- Chapter 10: Indian Economy

What Our Students

Say About Us

“ Top coaching for CA Foundation, I like the faculty approach for practice and explaination of every concept. Support team is too good. Thanks “

Aarnav Goel - CA Foundation (January 2025 Exams) Marks: 324/400

“ I would like to thank IGP and great faculty for making learning fun and meaningful. Thanks once again 😃.“

Bhumika - CA Foundation (January 2025 Exams)

“ With your faculty help I passed my foundation exams... “

Nitin Tomar - CA Foundation (January 2025 Exams)

“Very goodd experience with igp live classes at home!!!✨“

Jia Kaur Kohli - CA Foundation (January 2025 Exams)

“ Thank you for your support and guidance💫✨️. “

Umam Sadiq - CA Foundation (January 2025 Exams)

“ Thank you for giving us best faculty and guidance... “

Ishika - CA Foundation (January 2025 Exams)

Copyright © 1999 - 2025 IGP. All rights reserved.